As May wraps up and June follows closely behind, we’re nearly at the halfway point of the year. Over the past few months, I haven’t been as active in sharing investment updates, largely due to personal priorities. And frankly, with the markets showing increasing signs of irrationality, something we’ve seen more of since the Trump era, it’s been a challenge to stay fully engaged.

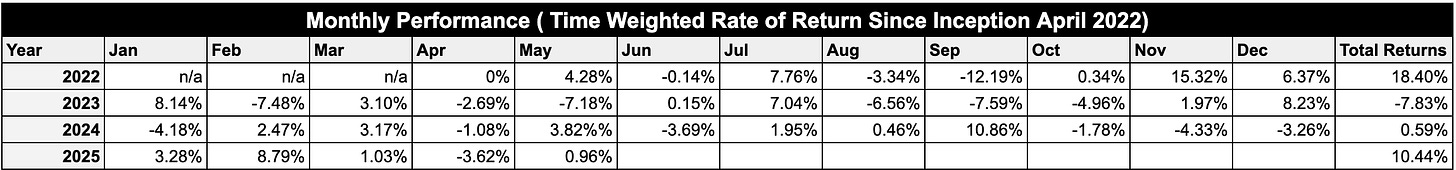

May brought notable contrasts and renewed volatility across global markets. My portfolio was up 0.96% for the month, though I continue to trail the S&P 500 over the longer term. This underperformance, I believe, reflects the reduced attention I’ve given to the portfolio recently. That’s something I’m aiming to change going forward. As we move into the second half of the year, I plan to re-engage more fully with the process, because beyond returns, investing brings me genuine intellectual satisfaction.

China: Ongoing Challenges

Chinese equities continued to lag in May, underperforming most global benchmarks. Since the 1990s, they’ve delivered only about ~3.3% in annualized real returns, far behind US equities according to UBS. Several structural issues remain:

Companies reinvest most profits at low returns, with return on equity falling from 10% to 6% over the past decade.

Weak corporate governance, shareholder dilution, and insufficient property rights have only made things worse.

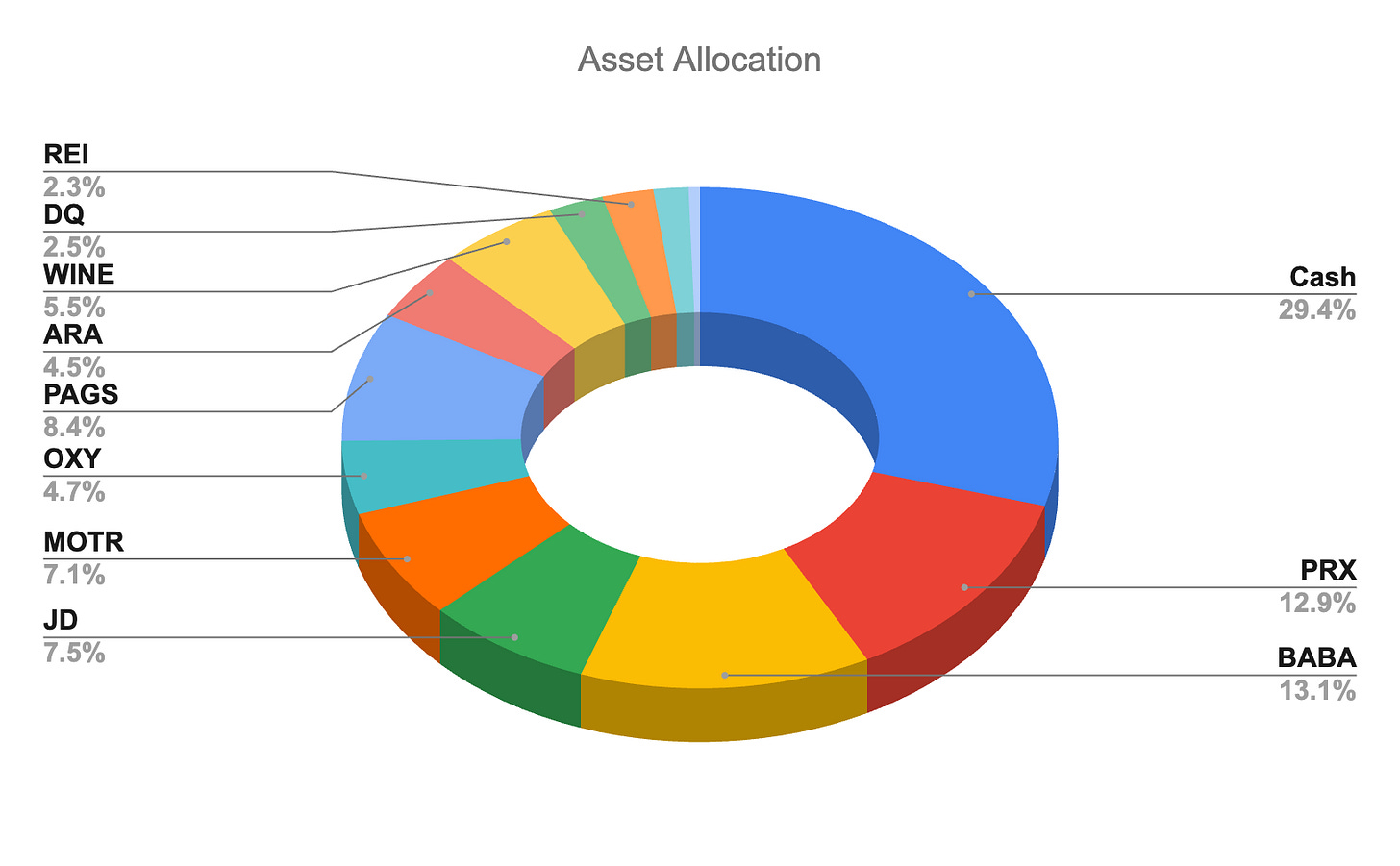

Even the inclusion of big-name tech companies in major indices hasn’t helped reverse the trend. Given these headwinds, Chinese stocks still trade at significant discounts, and I remain highly selective, sticking to a few high-conviction names with long-term potential.

US Markets: Rebound and Caution

In contrast, US markets bounced back strongly in May. The S&P 500 gained around 7%, erasing earlier losses and pushing year-to-date returns into the green. Why is that?

Reasonable economic data

Good corporate earnings

Continued expectations for modest earnings growth

Despite ongoing policy uncertainty and headline risk, strong employment and high corporate margins supported the rally. However, the concentration of returns in a small group of mega-cap stocks remains a key vulnerability. In light of this, I’ve kept my US equity allocation steady but added to positions in undervalued energy names.

One such energy name is REI 0.00%↑ Ring Energy, where I recently increased my exposure. While their Q1 2025 revenue fell short of expectations, the business fundamentals remain strong:

Production exceeded guidance, with 12,074 barrels of oil per day and 18,392 Boe/d sold.

Generated $38.2 million in operating cash flow, with lease operating costs below guidance.

Plans to cut capex by over 47% for the rest of 2025, prioritizing free cash flow even in a weaker oil price environment.

Recent acquisitions expanded drilling inventory by over 40 gross locations, boosting production 9% above initial estimates.

Despite a 17% stock drop in May, Ring remains profitable. With oil making up 97% of revenue and a focus on low-cost assets in the Central Basin Platform, the company is well-positioned for future recovery.

I believe the market is undervaluing Ring’s ability to stay cash flow positive, maintain growth with reduced spending, and benefit if oil prices rebound. The current valuation presents, in my view, an attractive risk/reward profile.

Market volatility and mispricing are part of the journey. The key is to stay grounded in fundamentals rather than reacting to daily price swings. As history reminds me, markets can behave irrationally for longer than expected, but long-term investors who focus on intrinsic value tend to come out ahead.

That’s my approach: assess true value, maintain conviction until changes occur, and stay the course—even when sentiment turns negative, as we’re seeing now with China.

Closing remarks

May reinforced a few core principles: be selective, stay patient, and focus on fundamentals. I remain cautious on both Chinese and US equities overall, but continue looking for opportunities in undervalued, cash-generative businesses. My commitment to disciplined, value-oriented investing remains firm.

If you’re interested in deepening your understanding of this approach, I highly recommend "The Most Important Thing: Uncommon Sense for the Thoughtful Investor" by Howard Marks. It’s a timeless guide to navigating markets with patience, clarity, and discipline.

Thank you for your continued support.