I'd like to kick off this portfolio update by sharing a thought that Charlie once expressed to a BBC interviewer: “I think it’s in the nature of long-term shareholding that the normal vicissitudes in markets mean that the long-term holder has the quoted value of his stocks go down by, say, 50%.” He emphasized that it's important for investors to be ready to handle occasional market fluctuations and downturns: “You’re not fit to be a common shareholder, and you deserve the mediocre result you’re going to get compared to the people who can be more philosophical about these market fluctuations.” I’m still doing my best in order to ensure that I’m fit to be a long-term common shareholder in my companies.

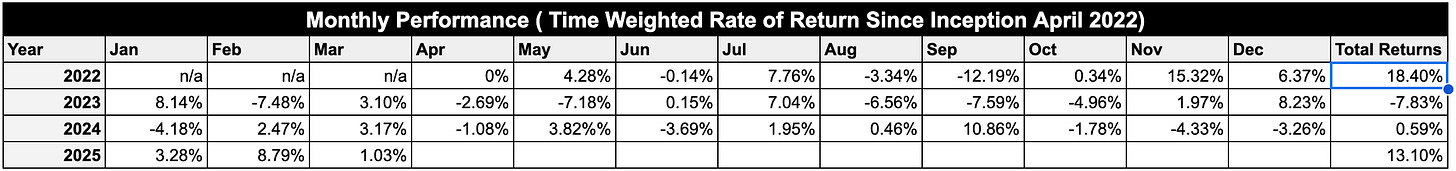

Following the exciting Chinese rally, the markets faced a bit of a hiccup due to Trump’s decision to decouple from the world, which led to half of the gains slipping away. However, I'm happy to say that my portfolio still managed to rise by 1.03% in March!

The past few months in the market have truly been a remarkable journey for me, challenging me psychologically and pushing my entire process to its limits. The significant market drops caused by political changes made me question whether I truly deserve to be a shareholder in some of my own businesses. Even though over 70% of my net worth is invested in various forms in the market, I’ve managed to adjust to Mr. Market's behavior. I remain positive and plan to keep accumulating, and if the drops persist, I’m excited about the opportunity to enhance the quality of my portfolio, most likely by swapping out some businesses for ones that I believe are stronger.

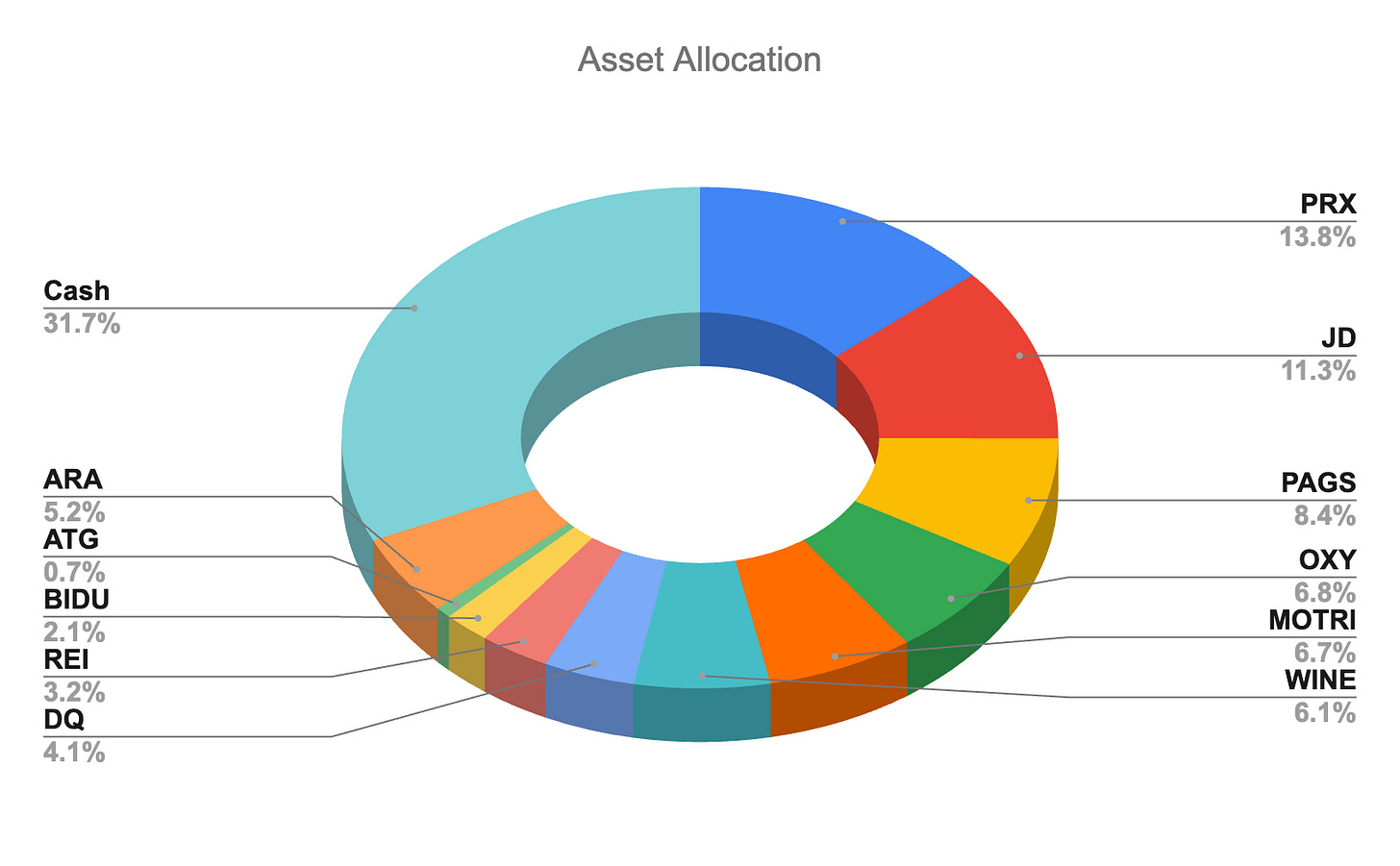

It looks like the current allocation hasn’t changed much, as you can see, but I did add a few more shares of REI 0.00%↑, and PAGS 0.00%↑. I made this decision because I really believe in their strong potential, considering their undervaluation. I think that Oil might become a scarce resource in the future, and neobanks will shine alongside traditional banks!

As I take a moment to reflect, I realize that the market is really no different today than it was a week, a month, or even years ago. Everyone involved has their own unique perspectives and goals, which means that our behaviors shape what happens in the short term, while our patience has a big impact on the long term. So, I’m keeping a positive attitude while I wait for great business opportunities to come my way on sale! I’m staying attentive to my watchlist, acknowledging my past mistakes, and enjoying the journey of continually learning and growing my skills, especially when it comes to understanding the psychological side of investing.

Closing remarks

As I wrap up this brief update, I want to emphasize some of the things I consider extremely important:

The world is more interconnected today than ever before. Events in one region increasingly ripple across global markets.

Nobody knows the future. That includes DJT, too.

Good things happen to those who are patient.

Risks can’t be eliminated, but you can prepare for them.

If you blindly follow others, you will achieve less than what those you are following will achieve.

There are many paths to success, and the best one for you is your own path.

I’ll leave you with a resource: Michael Shearn’s The Investment Checklist. This framework helps investors develop rigorous research processes—from idea generation to evaluating business quality and management—to avoid emotionally driven mistakes.

When you base your purchase decisions on isolated facts and don't take the time to thoroughly understand the businesses you are buying, stock price swings and third-party opinions can lead to costly investment mistakes. Your decision-making at this point becomes dangerous because it is dominated by emotions, so avoid this.

Stay patient, stay curious, and own your process.