I’ve been feeling off balance for much of this year, and I’m sure I’m not alone since the world as we know it, seems to be changing beneath us. When I feel unbalanced, I find myself being reactive and responding to events around me, which isn’t good for me.

Therefore, as an investor, I have learned to step back and try to understand the bigger picture, gain perspective, and return to basics despite missing out on some market opportunities. This is also the reason for my delayed portfolio update write-up.

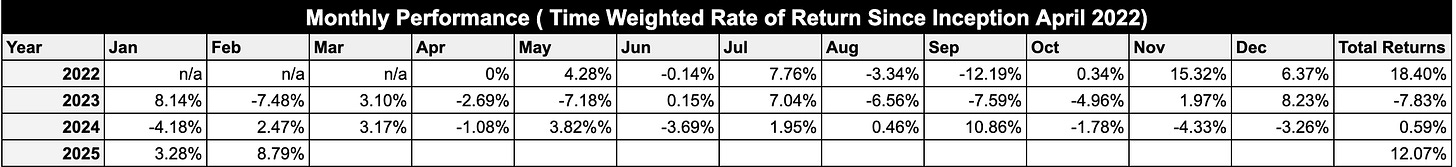

Patience is key when it comes to investments. I'm pleased to share that 2025 started on a positive note for me. In February, my returns were 8.72%, bringing a much-needed smile to my face. After waiting patiently for my investment thesis to unfold, it seems I'm gradually achieving my desired rate of return.

February 2025 highlighted a notable divergence between the economic and market performances of China and the United States. China's economy and equity market exhibited robust growth, while the U.S. faced challenges amid economic uncertainties, inflation concerns, and TRUMPism.

In China, industrial output grew by a strong 5.9% year-over-year in the first two months, with fixed-asset investment rising by 4.1%. Retail sales also increased by 4.0% during January and February, indicating growing consumer confidence. This steady growth suggests that China's economy is firing on all cylinders. The stock market mirrored this optimism, largely driven by excitement around AI and technological advancements. Companies like Alibaba, Tencent, and Xiaomi were among the top performers.

Conversely, the U.S. saw retail sales rise by only 0.2% in February, falling short of expectations. This modest rebound, following a 1.2% drop in January, hints at ongoing economic growth in the first quarter amid uncertainties stemming from tariffs and federal layoffs. Year-on-year, sales rose by 3.1%, with notable gains in online and health store receipts. However, spending at auto, furniture, clothing, and electronic stores declined. The drop in restaurant and bar sales indicates cautious consumer sentiment, exacerbated by low food service spending and falling gas prices. Tariffs under Trump raise concerns about inflation, job, and income losses, potentially hampering future sales.

Major U.S. stock indices like the S&P 500, Dow Jones, and Nasdaq all declined in February, with the Nasdaq particularly affected, dropping 5.5%. This, combined with some downward revisions by analysts, has raised concerns about the overall health of the economy.

In summary, China's strong economic indicators and stock market rally suggest that their focus on tech and innovation is paying off, presenting potential opportunities for investors. Meanwhile, the U.S. market is facing economic uncertainties, inflation concerns, and the implications of recent tariff policies.

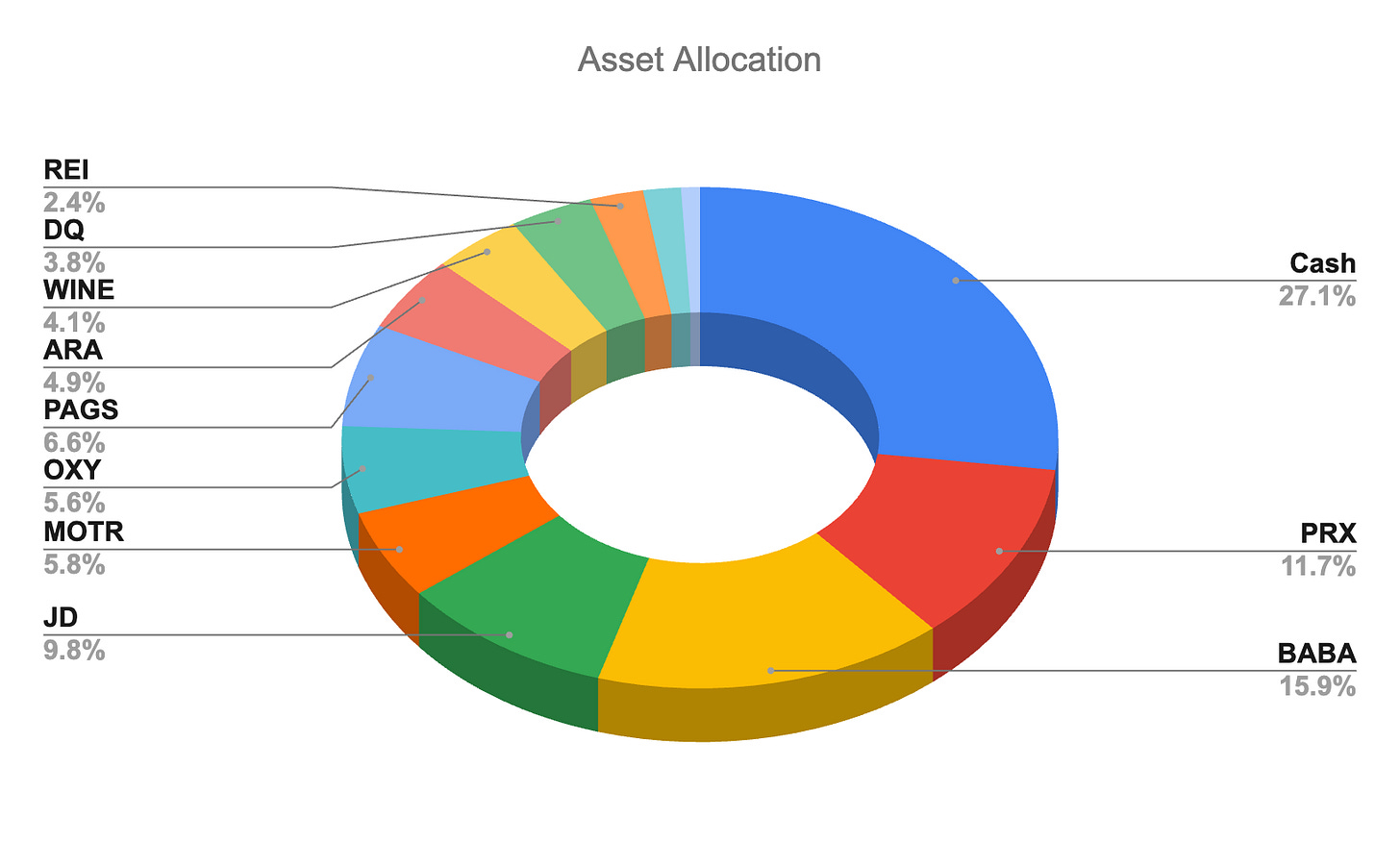

During such times, I feel uneasy making significant changes to my portfolio. However, I did increase my positions in REI 0.00%↑ and PAGS 0.00%↑, as I believe they are both extremely undervalued, especially when considering the overvaluation of their peers in the U.S. market.

By the way, have you noticed any trends in your businesses? How are your businesses navigating the current economic landscape?

Closing remarks

As I wrap up this brief update, I'd like to share some inspiration from "How I Made It" by Rachel Bridge, a collection of stories from 40 successful British entrepreneurs featured in The Sunday Times.

This book offered me a refreshing perspective on entrepreneurship, highlighting that success is not dependent on academic credentials or a specific background. Instead, it emphasizes the importance of perseverance and hard work. Each entrepreneur's journey is unique, yet they all share a common thread of overcoming obstacles and turning their dreams into reality.

The book is an engaging read that reminds us that success can be achieved through diverse paths and at any stage of life. It serves as a powerful reminder that in the world of finance and entrepreneurship, resilience and determination are key to achieving success.

Wishing you all clear minds in these dynamic times.