Future Prospects of Danaos Corporation

About Danaos Corporation, one of the largest independent owners of modern, large-size containerships.

Analysis Summary

The shipping industry is changing a lot this year. Let's talk about what's going on. Many companies are using fancy tech stuff to work better, but there are some big problems too. The economy isn't doing great, so shipping might slow down, and that could mean less money for shipping stuff. Some businesses want to lock in prices for 2024 because they think they're fair. To me, it seems like there’s it's a tricky time for shipping companies.

Thanks to my friend from Quant Compounding, I got introduced to Danaos Corporation. DAC 0.00%↑ is a big player in the shipping world, and they're up for sale at $1.39B with a free cash flow of ~$539m, earnings of $28.95/diluted share, and a clean balance sheet with a net debt of only $138m. They're doing alright financially, with a decent amount of money left over after paying for everything. They've got a bunch of fancy ships that they rent out through long-term charter agreements established at fixed rates, and so the company services a significant portion of the world's largest liner companies.

Circle of Competence

Business Analysis

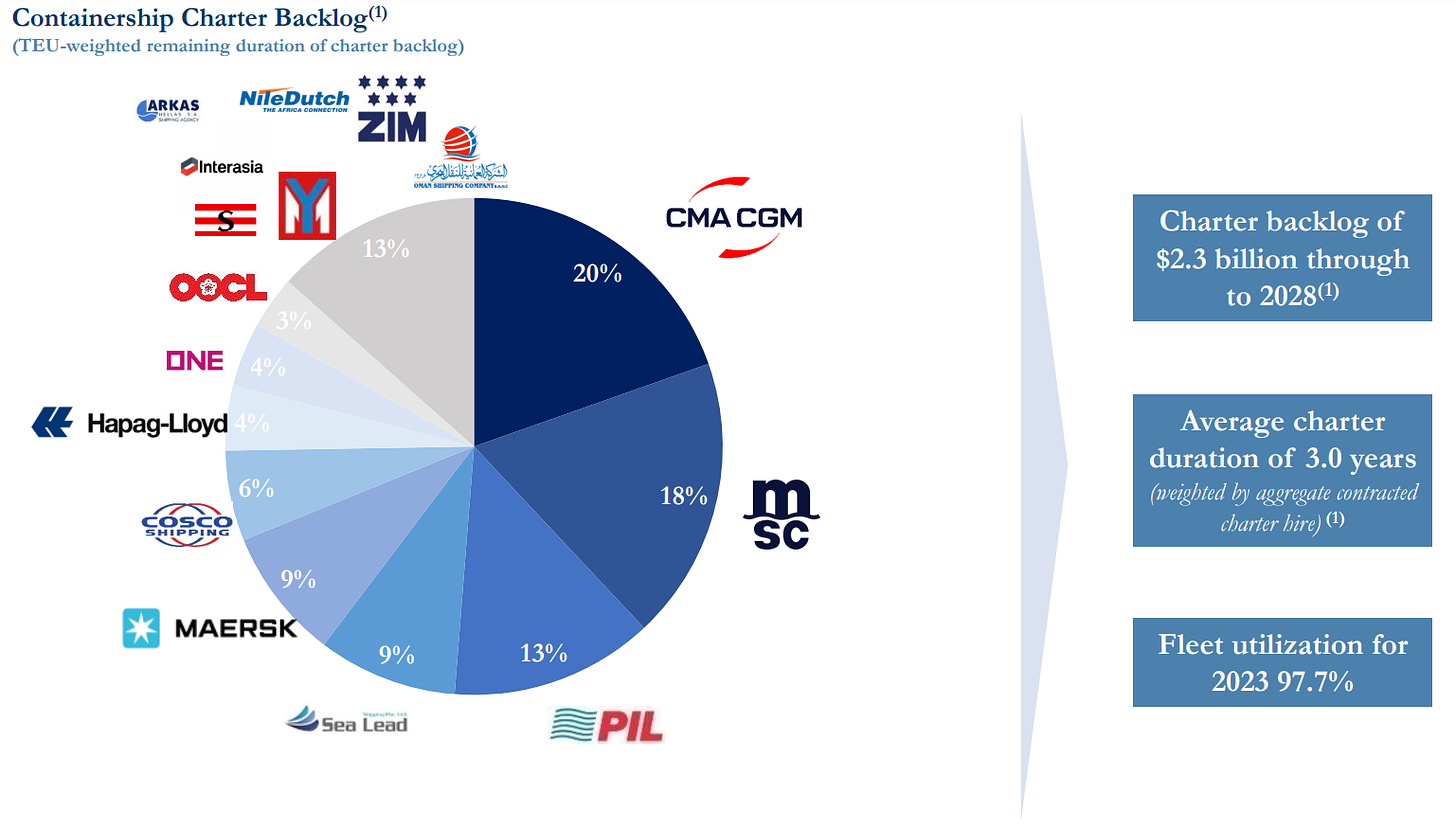

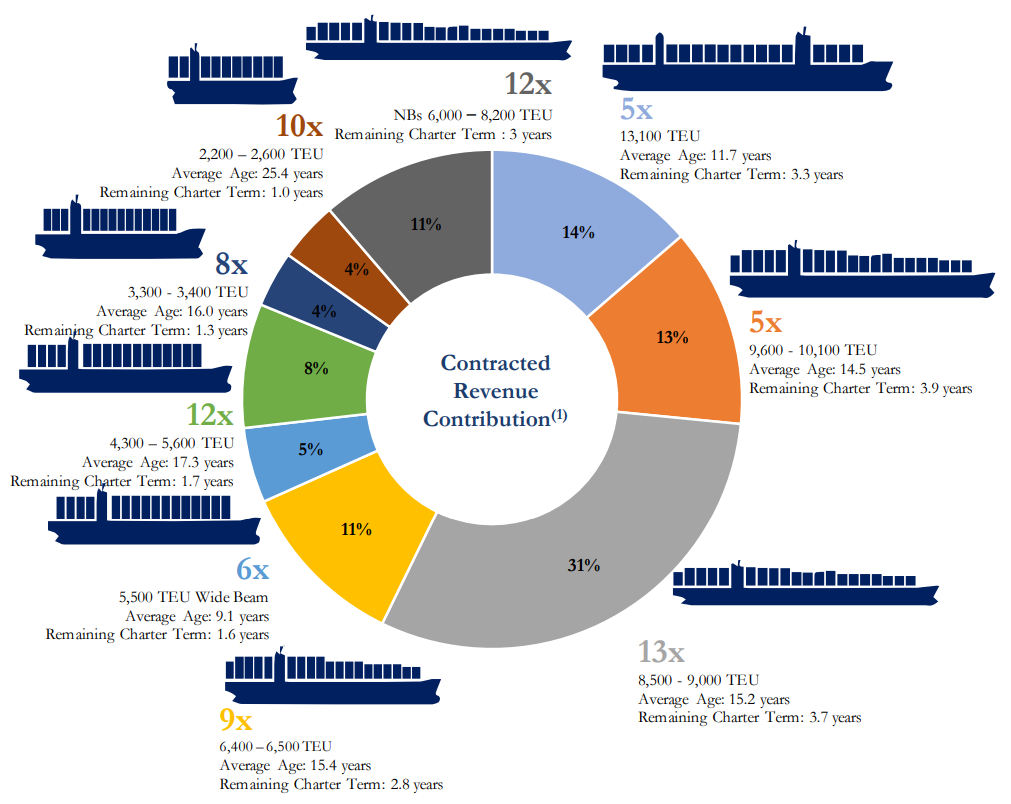

Danaos Corporation, operates across Australia, Asia, Europe, and the United States. They stick to a simple plan, focusing on long-term deals with major liner companies. By March 7, 2023, they had 68 ships holding 421,293 TEUs and were building 6 more with a capacity of 46,200 TEUs. Their goal is to keep the cash flowing and avoid market risks, so they rent out their ships for fixed periods to a bunch of big liner companies, including CMACGM, HMM, MSC, Yang Ming, Hapag Lloyd, ZIM, Maersk, COSCO, OOCL, ONE, PIL, KMTC, Niledutch, Samudera, RifLine, OSC, and TS Lines.

Since becoming a public company in 2006, Danaos has boosted its TEU carrying capacity by over three times. Their fleet now boasts some of the biggest containerships globally, equipped with advanced technology and tailored adjustments for faster voyages and better loading, outperforming many other ships in the industry.

Danaos Corporation stands as one of the biggest owners of modern containerships in the public domain, boasting a rich 50-year legacy in shipping. They're known for their efficiency, operating at breakeven levels that keep them highly competitive. Their key activities revolve around the operation and management of a fleet of container ships. With a charter backlog worth $2.3 billion stretching to 2028, thanks to deals with top liner companies, they have solid cash flow predictions. This hefty revenue backlog indicates to investors that a sizable chunk of future income is already secured, providing a safety net and reducing risks associated with upcoming revenues.

In 2024, Danaos Corporation has 95.8% of its operating days covered by contracts, dropping slightly to 62.0% in 2025, ensuring a stable income stream and mitigating risks during economic downturns. However, it's worth noting that the industry currently faces an oversupply.

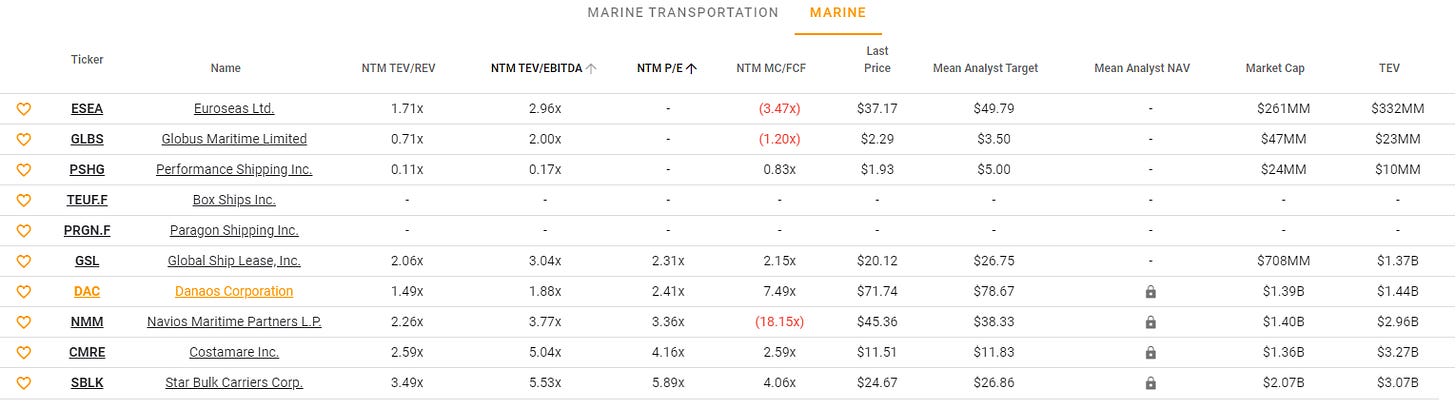

I think Mr. Market tends to value companies in this sector with a 'one size fits all' approach, primarily based on supply and demand dynamics, rather than considering factors like free cash flows or assets. Of course, there's always room for error in such assessments, and I may not have it entirely right.

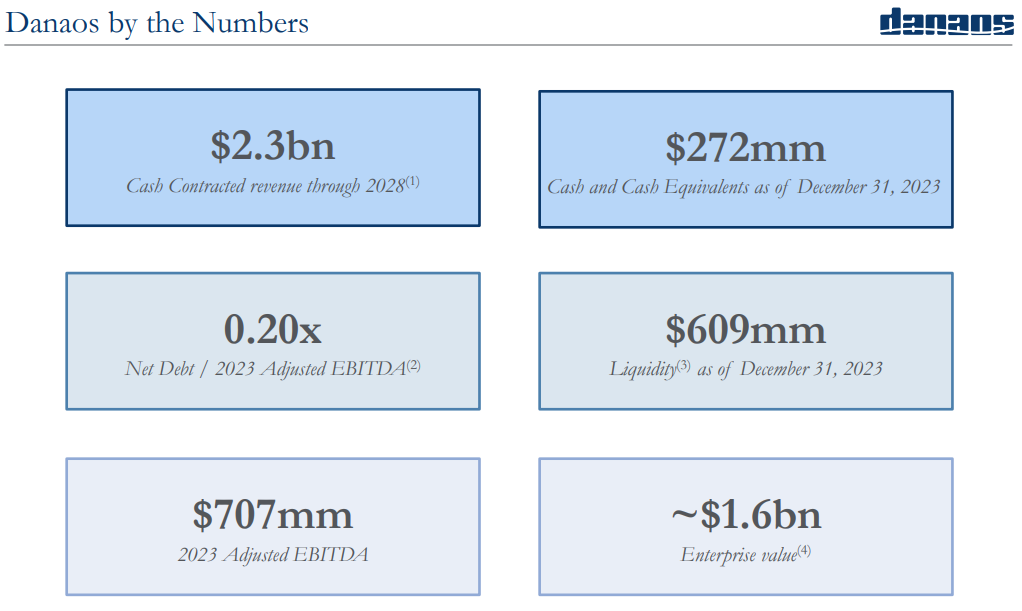

What catches my attention is their ability to maintain positive cash flow even if their revenues dip to pre-pandemic levels. Historically, they struggled with profitability due to hefty debt and interest costs. However, by trimming down their debt burden, including early repayment of $972.2 million since 2022 and opting for leaseback arrangements, they've significantly lightened their load. This move has slashed their net leverage by approximately 7 times. As of December 31, 2023, their Net Debt to Adjusted EBITDA ratio stands impressively low at 0.20x.

Competition Analysis

Danaos' profitability and growth hinge on its capacity to expand existing partnerships with charterers and secure new time charters, although this endeavor will encounter stiff competition. Moreover, great competition in the technological sphere could potentially diminish their charter hire income and the value of their vessels.

The business faces considerable competition from various seasoned companies, including state-backed entities and prominent shipping firms. Some of these rivals boast substantially larger financial reserves, enabling them to manage bigger fleets and potentially offer more competitive charter rates. Additionally, other marine transportation entities, renowned for their robust reputations and ample resources, might venture into the containership sector. This competition could lead to intensified pricing battles for time charters and, for both pre-owned vessels and newly constructed ones.

Danaos' primary competitors consist of Costamare ($CMRE), ZIM Integrated Shipping Services ($ZIM), Navigator ($NVGS), Navios Maritime Partners ($NMM), DHT ($DHT), Genco Shipping & Trading ($GNK), Global Ship Lease ($GSL), and numerous other players in the industry.

If you anticipate a resurgence in the containership sector, it's possible that new investors will be interested in the ownership of top-notch ships, a reasonable scale, and a robust balance sheet. In this case, Danaos Corporation stands out, as most others in the field carry higher levels of leverage.

Key Financial Indicators

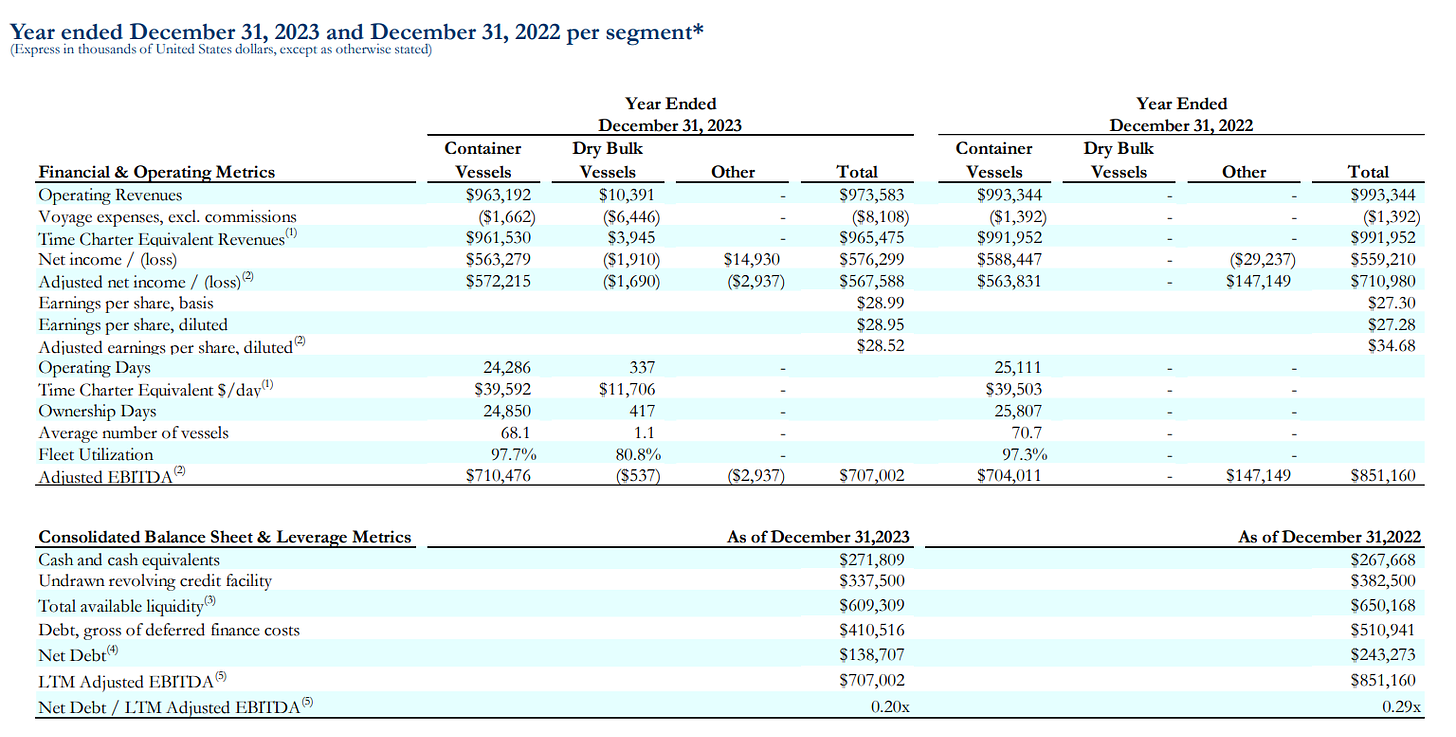

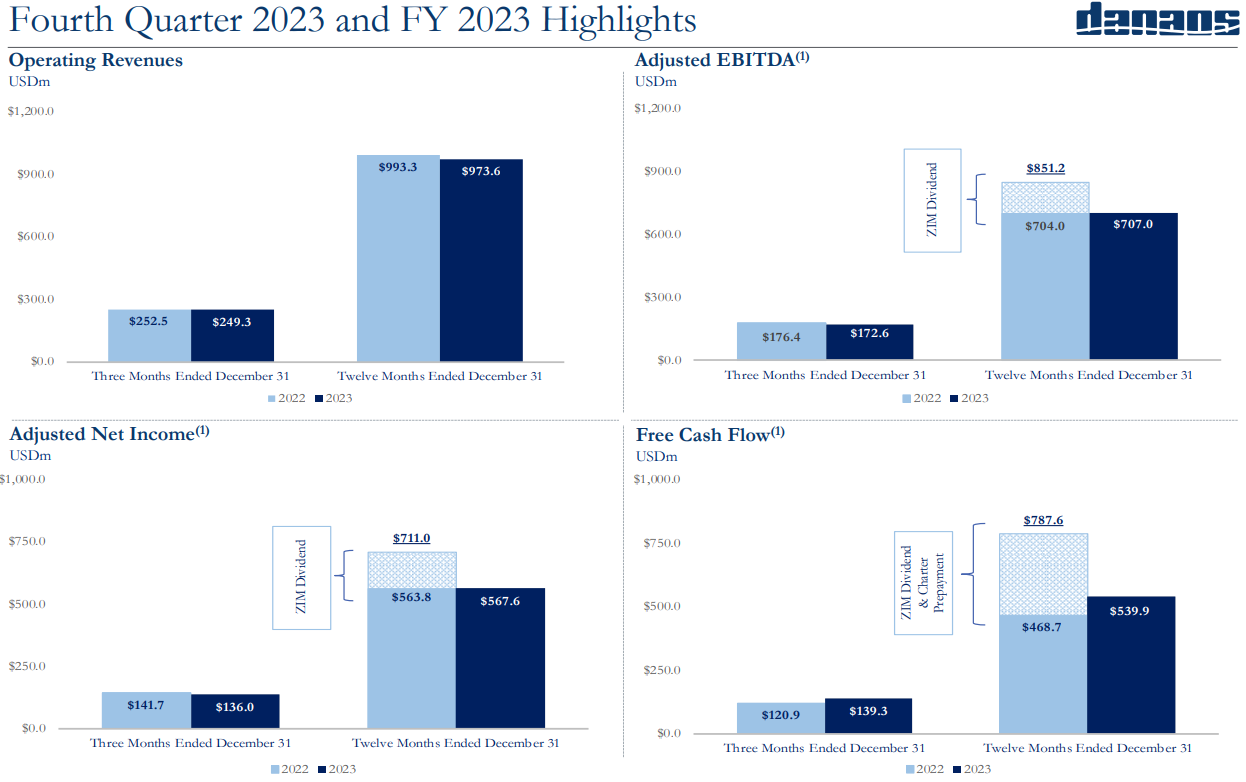

Danaos Corporation has maintained robust financial performance, based on high fleet utilization and favorable market conditions. Let's look into some key metrics from their latest Year Ended financials:

Revenue: FY 2023 revenue hit $973.58 million. It's worth noting that 2021 saw exceptional revenue, driven by fleet operations and the appreciation of their ZIM investment.

Profitability: Danaos remains highly profitable, with FY 2023 net income reaching $576 million and Earnings per Share standing at $28.95. While still profitable, these figures are slightly lower compared to the exceptional performance of 2021, which benefited from asset sales.

Fleet Utilization: Danaos continues to efficiently utilize its fleet, achieving a container vessel utilization rate of 97.7% in 2023, up from 97.3% in 2022. This underscores their ability to meet strong market demand effectively.

Debt Levels: Danaos maintains a relatively low debt profile, with total debt at $404.17 million, partly offset by a cash position of $271.81 million, resulting in a net debt of $132.37 million. This represents a significant improvement over their historical debt levels.

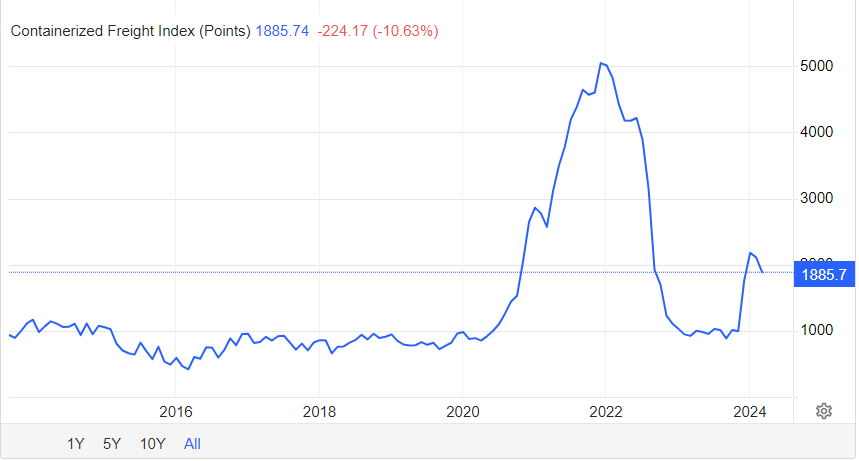

Overall, these financial figures offer a comprehensive view of Danaos Corporation's journey. While the FY 2023 financials show a positive trajectory, future performance will hinge on factors such as global economic conditions and freight rates, which currently stand above average, as illustrated below.

The recent inclusion of Capesize bulk carriers introduces a new dimension to their operations, although its influence on future performance is yet to be determined.

Nevertheless, Danaos Corporation appears to be valued based on the expectation that its operations will decrease annually over the next 2-4 years at a rate of 10% to 12%.

Risk Factors

Despite its recent strong performance, Danaos Corporation faces several significant risks that could affect its future profitability. Here's a breakdown of some of the most pertinent ones:

Economic Downturn: A global economic slowdown could reduce demand for containerized shipping, leading to lower freight rates and potentially decreased fleet utilization for Danaos.

Fuel Price Volatility: Danaos' operating costs are vulnerable to fluctuations in fuel prices. While they may have hedging strategies in place, unexpected spikes in prices could squeeze their profit margins.

Geopolitical Instability: Tensions and disruptions on the geopolitical stage can disrupt shipping routes and trade patterns, affecting Danaos' ability to operate its fleet efficiently and generate revenue.

New Shipbuilding & Overcapacity: A surge in new ship construction could result in overcapacity in the container shipping market, driving down freight rates and potentially impacting Danaos' profitability.

Environmental Regulations: Stringent regulations on emissions from container vessels could necessitate costly upgrades for Danaos, affecting their financial bottom line.

It's important to note that these risks would impact Danaos' competitors as well. Therefore, closely monitoring their strong balance sheet and positive cash flow during downturns is crucial.

Moat

Qualitative Moat Analysis

The shipping industry presents numerous challenges, but Danaos Corporation distinguishes itself by offering an attractive value proposition to its clientele it seems. Their emphasis on cost efficiency, reliability, sustainability, and innovation sets them apart from competitors. Recognizing the unique needs of each customer, Danaos provides personalized and adaptable shipping solutions, aiming for high levels of customer satisfaction.

Danaos harnesses technology and streamlined operations to deliver cost-effective shipping services. This results in significant cost savings for clients in transportation expenses, while punctual and dependable deliveries ensure safe and timely cargo arrivals, fostering trust and satisfaction.

Environmental responsibility seems to be integral to Danaos' ethos. They offer eco-friendly shipping alternatives, appealing to customers who prioritize sustainability. Constantly striving for improvement, Danaos actively invests in cutting-edge technologies to optimize operations and deliver innovative shipping solutions.

Positioning itself as a dependable and forward-thinking partner in the maritime sector, Danaos Corporation's commitment to cost efficiency, reliability, sustainability, and innovation makes it a valuable choice for businesses seeking efficient and environmentally conscious shipping solutions.

Quantitative Moat Analysis

From a quantitative standpoint, I don't believe Danaos possesses a significant economic moat. However, their successful deleveraging, solid strategic approach, and a substantial $2.3 billion charter backlog offer promising visibility into cash flow.

Overall, the company maintains a financially sound position.

CEO John Coustas has announced a boost in the quarterly dividend and has authorized an additional $100 million for share buybacks, showcasing confidence in the future of the business. Simultaneously, the company is pursuing diversification into sub-sectors by investing and holding a substantial position in Eagle Bulk Shipping Inc. (EGLE).

Conclusion

By summing up these various initiatives, Danaos Corporation establishes itself as a dependable and forward-looking ally in the maritime sector. Their dedication to cost efficiency, reliability, sustainability, and innovation makes them a valuable resource for enterprises seeking efficient and environmentally conscious shipping solutions. All the while, they maintain a healthy balance sheet and that’s extremely important during these times.

Management

Management’s integrity

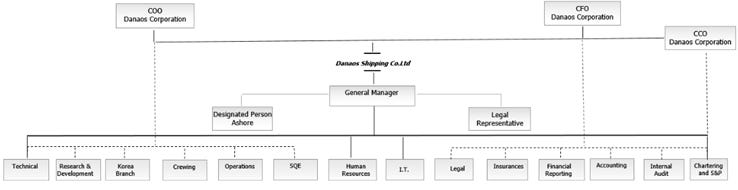

Dr. John Coustas serves as the President, Chief Executive Officer. With over 30 years of experience in the shipping industry, he assumed leadership of our company in 1987 from his father Dimitris Coustas, who founded Danaos Shipping in 1972. Since then, he has been instrumental in shaping the corporate strategy and managing the operations. Dr. Coustas holds a degree in Marine Engineering from the National Technical University of Athens, as well as a Master's degree in Computer Science and a Ph.D. in Computer Controls from Imperial College, London.

As a family-led enterprise, the most recent investment made by the Coustas family was in 2021, totaling $25 million. It appears that insiders hold a substantial portion of Danaos Corporation. Insiders collectively own shares valued at US$644 million in the company, which has a total market capitalization of US$1.3 billion. This level of insider investment is quite significant and is generally a positive.

It's worth noting that 72% of Danaos employees would recommend the company to a friend, according to Glassdoor reviews. Employees have rated Danaos 3.9 out of 5 for work-life balance, 4.0 for culture and values, and 4.1 for career opportunities. These ratings are quite favorable, particularly within the context of the industry.

Therefore, upon review, I was unable to identify any concerning indicators regarding the management's integrity.

Capital investment

The management of the company seems to have consistently overlooked rewarding common shareholders. From an operational standpoint, Danaos' management has effectively navigated the industry's dynamics to achieve success. They secured long-term leases during the peak of the containership industry in 2021 and have diligently used their substantial cash flows over the past two years to significantly reduce debt. However, despite the company's operational achievements, management has been hesitant to distribute rewards to shareholders. For context, Danaos has generated a free cash flow of $450 million over the past 12 months, yet buybacks and share repurchases have amounted to just $120 million during this period. Instead of accumulating a stake in Eagle Bulk Shipping (EGLE), Danaos' management could have considered using its growing cash position for more aggressive buybacks.

Additionally, the company's acquisition of 5 Capesize bulk carriers built between 2010 and 2012 for a total of $103 million raises questions about whether such investments will prove more beneficial for shareholders compared to dividends or buybacks. Only time will tell.

Debt Management

It's remarkable how Danaos has managed to pay off so much debt in recent years that its enterprise value has regressed to COVID lows, even halving compared to 2016 levels when future earnings were less certain. While substantial debt levels could restrict their flexibility to secure additional financing, their ability to service outstanding indebtedness hinges on future operating performance.

It's encouraging to see that the company is funding its vessel acquisitions internally and refraining from taking on additional debt to expand its fleet. Management has noted that 44 of its container vessels and four recently acquired dry bulk vessels are debt-free.

With a Net Debt / EBITDA of 0.20x , Danaos may boast one of the strongest debt ratios in the industry.

Market Value

DAC is currently trading at a 2024 P/E ratio of just 2.6x. While earnings are expected to decline in 2025 and 2026 (estimated at around 3x - 4x, respectively), the company is still anticipated to generate a significant amount of free cash flow.

Despite having minimal debt, multiple years' worth of contracts secured at above-market rates, and easily valuated assets that can be liquidated, Danaos trades at only half of its tangible book value. That is cheap no matter what.

Although the containership industry is facing challenging times ahead, DAC appears to be in a far better position compared to previous downturns and is currently trading at a fraction of its historical value.

Intrinsic Value Conclusion

Reaching the fair value target of above $140 a share by 2026, based on assets, seems feasible if there's an upturn in charter demand and rates later in 2024 into 2025. That’s yet to be seen. I don’t see any catalysts for the time being.

However, with a recession looming, its impact will likely be felt across the board. Historically, analysts have underestimated the company's EPS growth potential by around 8%. Assuming a potential earnings surprise this time around, Danaos stock could be valued at ~ $90 by the end of the year, based on a P/E ratio of just 3x.

Shipping companies often face challenges with cyclicality, moving from periods of abundance to scarcity every few years, which tends to limit their P/E ratios. Therefore, it might be prudent to keep a close eye on Danaos and wait patiently for a more opportune moment. Danaos would have been an extraordinary investment in 2020 but I have missed it.

Sources:

https://tradingeconomics.com/commodity/containerized-freight-index

https://d18rn0p25nwr6d.cloudfront.net/CIK-0001369241/d611031e-afbb-4782-8b77-f84cd3d4582a.pdf

https://www.danaos.com/investors/press-releases/press-release-details/2024/Danaos-Corporation-Reports-Results-for-the-Fourth-Quarter-and-Year-Ended-December-31-2023/default.aspx

https://www.danaos.com/home/default.aspx

https://s2.q4cdn.com/951507448/files/doc_presentations/2024/02/DAC-Corporate-Presentation-February-2024.pdf

https://s2.q4cdn.com/951507448/files/doc_financials/2023/q4/Danaos-Corporation-Earnings-Release-Q4-2023.pdf

https://s2.q4cdn.com/951507448/files/doc_financials/2022/ar/DAC-Annual-Report-2022-spreadsF.pdf

https://simplywall.st/stocks/us/transportation/nyse-dac/danaos/health

https://www.freightwaves.com/news/container-shippings-big-disconnect-freight-rates-weak-charter-rates-robust

https://container-news.com/demolition-to-stay-in-the-doldrums/

https://commonstock.com/post/dc85bad3-65b6-4aa9-b256-ef36f43874d4

https://dcf.fm/blogs/blog/dac-business-model-canvas#Revenues

http://fernfortuniversity.com/term-papers/porter5/analysis/2707-danaos-corporation.php

https://dcf.fm/blogs/blog/dac-porters-five-forces-analysis

https://www.moomoo.com/news/post/30869303/danaos-corporation--nyse-dac--ceo-john-coustas--the-company-s-largest-shareholder-sees------reduction-in-holdings-value?level=1&data_ticket=1709556652862708

https://www.hellenicshippingnews.com/danaos-corporation-reports-lower-net-income-as-container-shipping-rates-decrease/

https://www.tradewindsnews.com/finance/container-ship-player-danaos-takes-10-slice-in-eagle-bulk-shipping/2-1-1468995

https://seekingalpha.com/article/4645074-danaos-amazing-risk-reward-buy-setup

https://seekingalpha.com/article/4655151-danaos-still-has-a-lot-of-room-to-run

https://seekingalpha.com/article/4669210-danaos-dac-stock-just-far-too-cheap-buy

https://seekingalpha.com/article/4643471-danaos-change-in-capital-allocation-mindset-needed

https://seekingalpha.com/article/4654999-danaos-q3-dividends-on-the-rise-buybacks-persist-is-it-enough

https://www.glassdoor.com/Reviews/Danaos-Reviews-E42224.htm

Thanks for the shoutout. Really enjoyed your write up!