$DIBS Quick Pitch

1stdibs.Com, Inc. is an e-commerce company which sells luxury items such as high-end furniture for interior design, fine art and jewelry.

DIBS 0.00%↑ #QuickPitch mcap= $157.18M, price $3.96 / share

DIBS 0.00%↑ #Pitch:

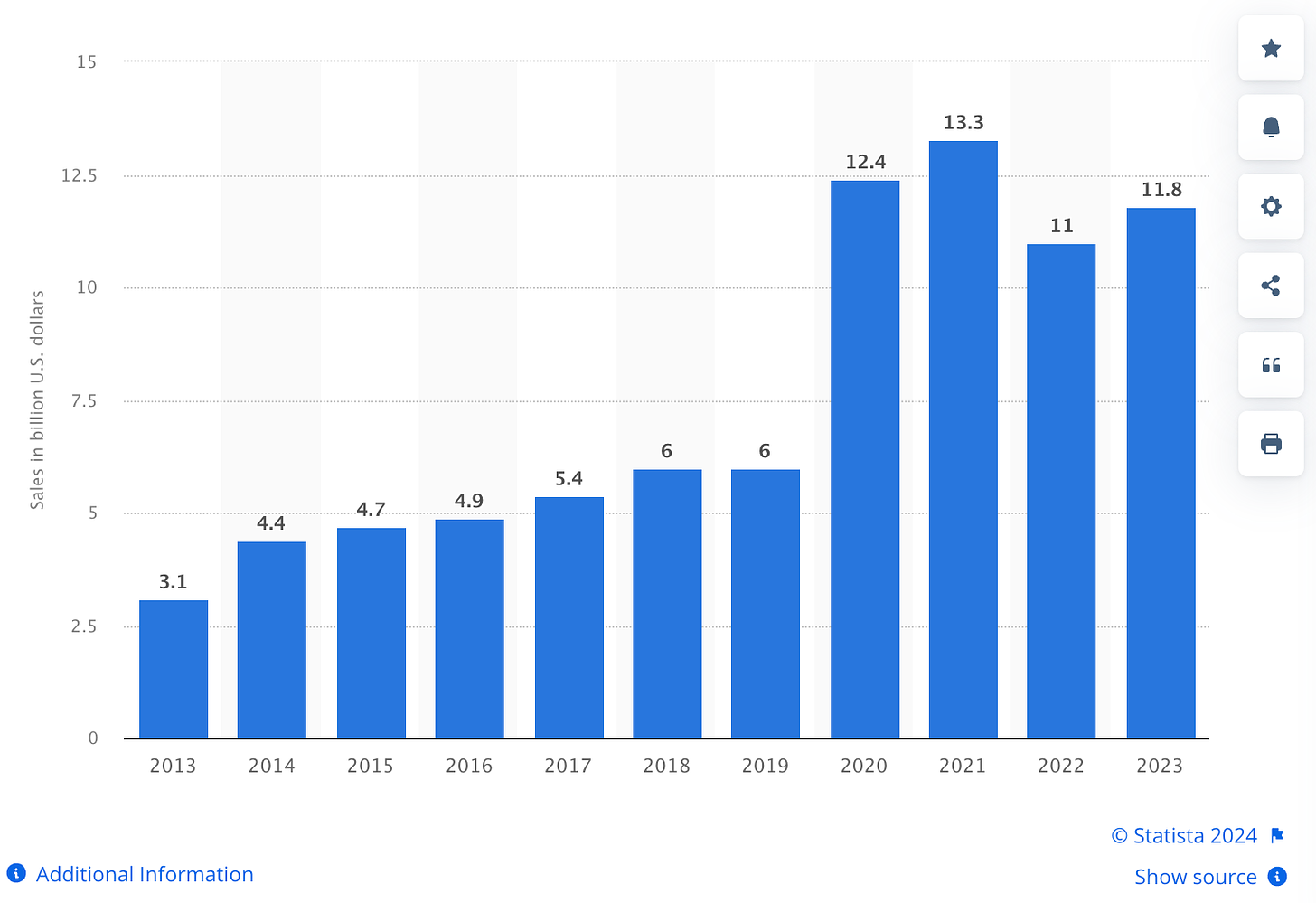

Before diving in, it’s worth noting that the global market for antiques and vintage items has shown resilience, growing by 7% in 2023 compared to the previous year. In fact, online transactions in the art and antiques space reached $11.8 billion, a substantial jump compared to pre-pandemic levels.

1stDibs caught my eye because it appeals to value hunters, particularly those with an eye for beauty and luxury in the Antique & Vintage industry. The company is recognized for modernizing the antiques business, bringing it into the 21st century with its curated platform.

1stDibs has captured the magic of the flea market, connecting those seeking the most beautiful things on earth with highly coveted sellers and makers in vintage, antique, and contemporary furniture, home décor, art, fine jewelry, watches, and fashion.

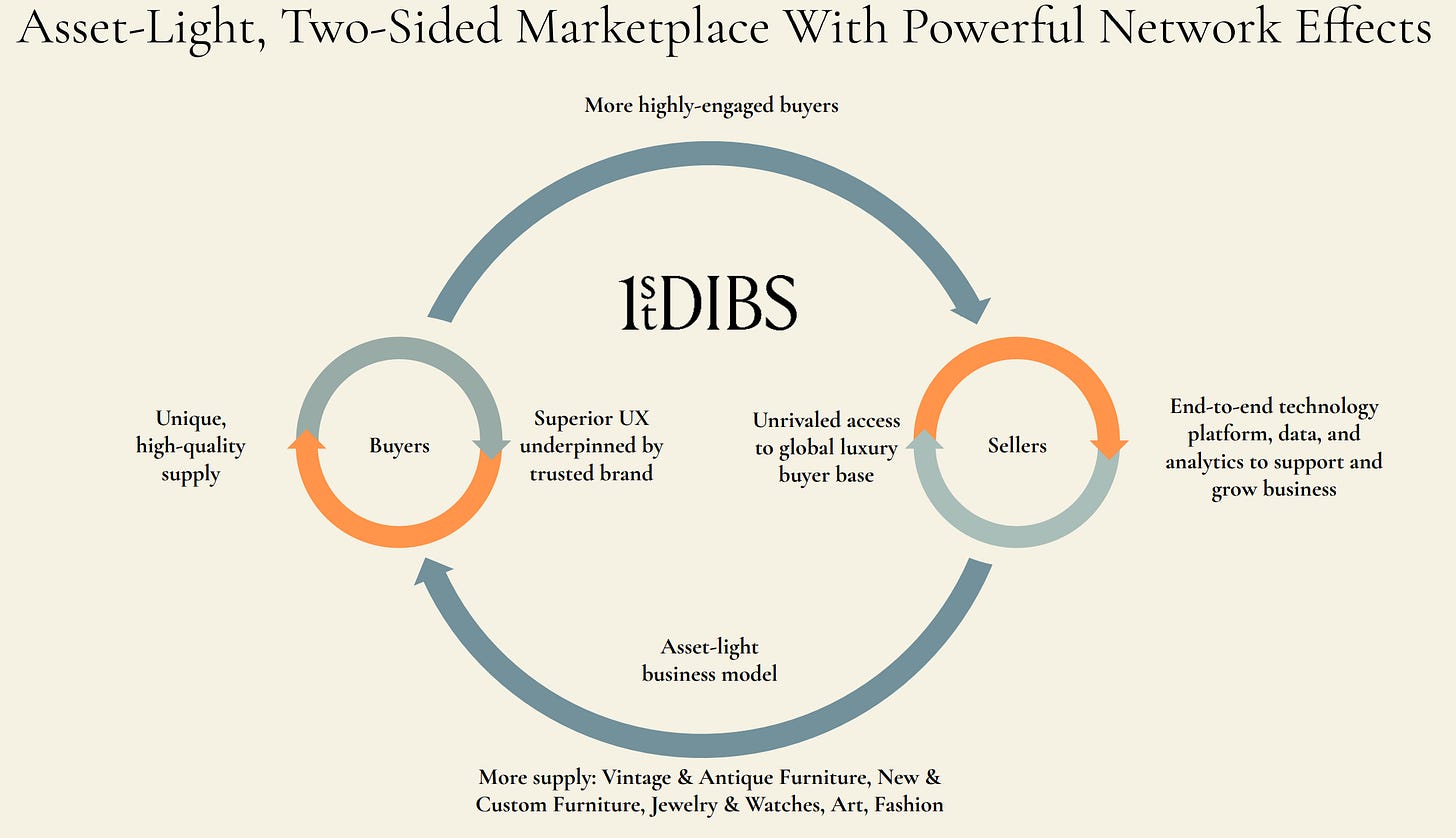

1stDibs captures the essence of the traditional flea market, creating a digital bridge between buyers and sellers of luxury items like vintage furniture, fine jewelry, and art. The business operates on an asset-light model, acting primarily as a marketplace facilitator.

While management believes its network effects are a significant strength, I’m skeptical given the company’s declining revenue since the pandemic boom, even with the addition of new verticals.

Management is cutting non-core programs like the Auctions feature and the Essential Seller Program to streamline operations and focus on profitability.

Being an online platform, 1stDibs faces minimal geographic barriers. It has the potential to grow in emerging luxury markets through strategic partnerships and localized marketing.

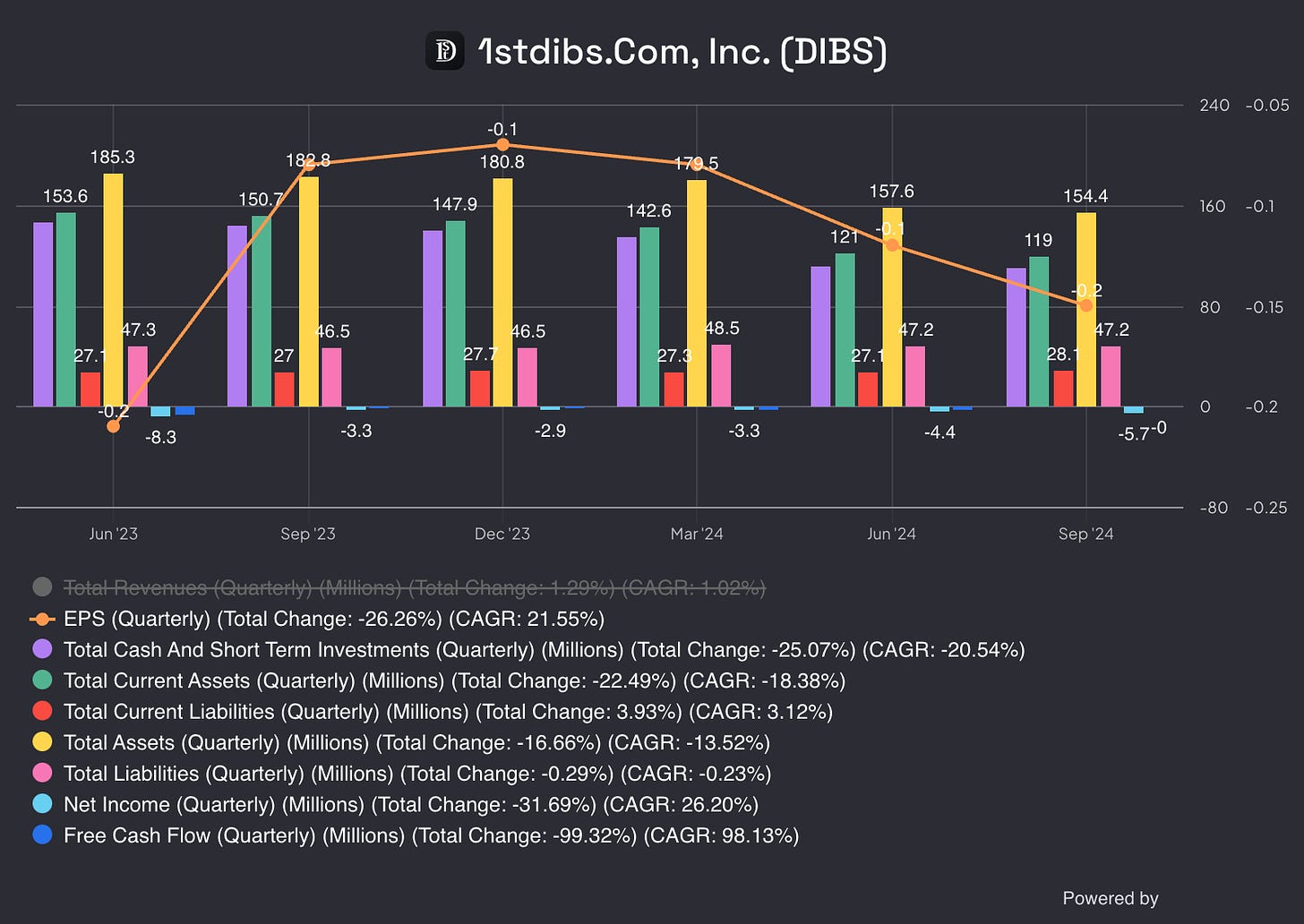

A 5% drop in Gross Merchandise Value (GMV) and an 11% fall in Average Order Value (AOV) indicate challenges in maintaining high-value transactions, a critical metric for profitability. However, the number of orders grew by 7% YoY in Q3 2024, reflecting improved customer engagement and smaller transaction sizes but the number of active buyers decreased by 1% year-over-year.

The $10 million stock repurchase program approved in August 2024 shows management’s confidence in the company’s valuation, although I remain unconvinced. Even with insider ownership at 8%, it’s not enough to make me bullish.

Operating at a net loss that would be even wider if stock-based compensation expenses is eliminated, 1stDibs faces challenges from broader economic pressures on discretionary spending.

If you’re not among the super wealthy, their products may not be for you. They proudly market themselves as the best in their field, but cracks are beginning to show. Seller churn increased due to policy changes, and unique seller numbers fell by 13%, raising concerns about maintaining platform supply. The items are nice but not worth the astronomical price unless you like to waste money which I don’t. To be fair, I can understand why some people splurge on such luxury items.

The company’s reliance on discretionary spending makes it highly vulnerable in today’s economic climate. Rising inflation, higher interest rates, and global economic uncertainties are piling on pressure. With heavily indebted economies, consumers are tightening their wallets.

Adjusted EBITDA margin deteriorated from -8.7% to -14.1% year-over-year, with losses widening to $5.7 million in Q3 2024. Persistent losses delay break-even and weigh heavily on my confidence. Increased operational costs, especially in technology and marketing, have outpaced revenue growth, and that’s not good at all.

DIBS 0.00%↑ #Valuation:

The company holds $109.4 million in liquid assets, ensuring it is well-capitalized to sustain operations and fund growth initiatives. This significantly reduces the risk of insolvency. However, with the current loss rate and economic challenges, I wouldn’t consider owning it. The shifting economic context makes businesses like this a tough sell for me. The company’s net cash position of $86.12 million, equivalent to $2.36 per share, offers a financial cushion.

In 2023, cash reserves dropped by $117.07 million, reflecting operational challenges. Cash flow from financing was negative, signaling the company did not rely heavily on external funding, which is a positive sign for financial discipline.

Gross margins fell to 71% in Q3 2024, underscoring the impact of rising costs. This narrowing of margins indicates increasing difficulty in balancing cost management with revenue growth. There’s a growing perception among sellers that the platform is not delivering the value they anticipated, which could impact supply dynamics.

Management is aiming to improve operating leverage by cutting costs and aligning revenue with key investments. This includes retiring underperforming features, while focusing on high-margin offerings and technology advancements.

Revenue grew 3% year-over-year in Q3 2024, reaching $21.2 million. While GMV (Gross Merchandise Value) declined, the platform showed resilience by attracting smaller, consistent orders. However, sustaining this growth without further margin erosion will be vital to achieving profitability in the long term.

Expected Gain: 1stDibs' current position and strategic direction it’s clear to me but the valuation remains a significant hurdle. If rate cuts occur, the price should go higher but that would be a bet on interest rates. Without a ~50% drop in price, I do not see a compelling risk-return profile for this business.

Very nice content. 🚀