$CROX Quick Pitch

Crocs, Inc. manufactures and markets the Crocs brand of foam footwear. Crocs, Inc. terms these "clogs", but they do not contain wood like traditional clogs.

CROX 0.00%↑ #QuickPitch mcap $5.55B, price $99.01 / share

$CROX #Pitch:

To me, Crocs Inc. resembles Lego as it aims to enter the fashion industry.

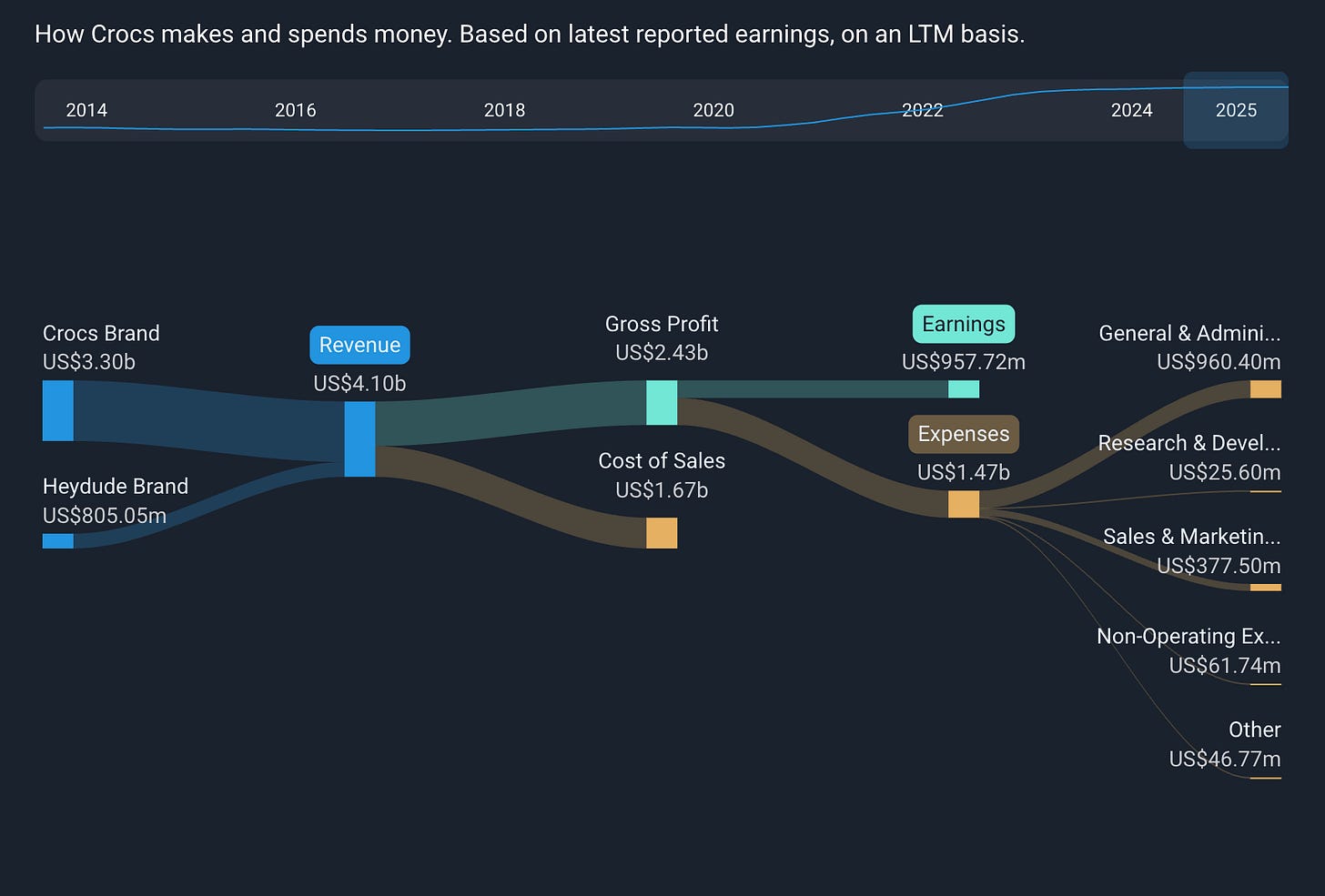

Crocs Inc. continues to demonstrate resilience in a challenging macroeconomic environment, with Q1 2025 results exceeding expectations despite ongoing tariff concerns. The company reported Q1 EPS of $3.00 (adjusted), significantly above consensus estimates, with revenues of $937 million outperforming expectations.

The core Crocs brand showed 2.4% year-over-year growth, while HEYDUDE continued to face challenges with a 9.8% decline. The company has withdrawn its full-year 2025 guidance due to tariff uncertainties, but recent developments suggest potential relief with tariffs on Chinese goods reduced from 145% to 30%.

There are key strategic developments, including the appointment of Terence Reilly as Executive Vice President and Chief Brand Officer overseeing both Crocs and HEYDUDE brands, continued focus on the company's three-pillar growth strategy, and progress on sustainability initiatives with the expansion of its take-back program to Europe. The company continues to leverage strategic collaborations and product innovations to expand brand awareness and appeal, while maintaining strong gross margins of 57.8%.

The company continues to strengthen its core brand through strategic collaborations like the recent partnerships with Bath & Body Works, Batman, Squishmallow, and McDonald's. With Echo (a very ugly clog from my pov but who am I to judge) alongside upcoming launches like Echo Wave, Molded Mule, and Echo Search, product innovation continues. Sandals have been a key growth driver, with 54% of sandal purchasers in the last 12 months being new to the brand. In addition, InMotion clog (at $60 price point), global and product expansions of popular sandal styles (Getaway, Miami, Brooklyn), increased focus on slippers, and continued growth in Jibbitz and collaborations, Crocs seems to be focused in gaining as much market share as possible.

Recent financial performance Q1 2025 exceeded market expectations with revenue around $937 million, a net Income increase of 5.0% to $2.83 per diluted share, compared to $2.50 in the same quarter last year, and an expansion of gross margins to 57.8% (HEYDUDE is laging behind and I do not have trus in such a brand).

The company demonstrated particularly strong international momentum with core brand sales up 4% in constant currency, beating forecasts, but the USA declined 3%. though showing signs of improvement.,

Crocs Inc. continues to focus on shareholder value creation, repurchasing $61 million in shares during Q1 2025, as part of the buyback program of $1.3 billion remaining on the current share repurchase authorization. This happens while paying down debt and maintaining a net leverage target of 1 to 1.5 times.

Challenges and risks exist for Crocs as for any other company. Currently, I consider tariff uncertainties to represent a significant challenge. In 2025, approximately 15% of enterprise imports are projected to come from China (Crocs at 10%, HEYDUDE at 27%). Tariffs are expected to reduce gross profit by about $11 million, lowering gross margins by around 25 basis points

Crocs also faces potential vulnerabilities in its supply chain due to its 100% outsourced manufacturing to third-party partners across Vietnam (53%), China (15% of U.S. imports), and India (10%).

The HEYDUDE brand continues to decline 9.8% year-over-year, while Crocs faces ongoing legal challenges related to the HEYDUDE acquisition.

I truly appreciate that Crocs is focused on protecting long-term brand value over short-term sales volume. Also, the proactive cost management aims to mitigate tariff impacts and maintain profitability. I am a bit concerned that social commerce, particularly through TikTok Shop, is a key sales driver.

$CROX #Valuation:

With a P/E ratio of 6.7x and strong gross margins, Crocs appears undervalued relative to peers and its growth potential. But how big is that potential? I think we’ve seen its peak in 2021-2022 in terms of volumes.

Despite tariff concerns, the company has demonstrated the ability to maintain strong gross margins through cost management and pricing strategies. Strong performance in international markets suggests significant growth potential in regions like China, India, and Western Europe.

Success in expanding beyond core products (particularly in sandals) shows potential for sustained growth through product innovation, while HEYDUDE turnaround potential might never happen despite the change in leadership.

Continued share repurchases and effective debt management demonstrate a commitment to shareholder value.

Crocs is attractively valued, boasting a strong gross profit margin of 59.25% and a return on asset above the industry average of 7.75%, as well as a debt-to-equity ratio higher than the industry average at 0.93.

So, Crocs Inc. is experiencing a significant decline in its stock price over the past year, with a 33% decrease in total return. However, the company maintains strong profitability margins and a relatively low P/E ratio, indicating potential undervaluation by the market. The forward P/E ratio of 6.4 suggests that the market expects stable earnings in the near future.

Expected Gain: Based on my mental calculation, Crocs Inc. provides an intrinsic value above $160, if not $200, which represents more than 60% potential upside from the current share price.