$CHGG Quick Pitch

Chegg, Inc., is an American education technology company based in Santa Clara, California. It provides homework help, digital and physical textbook rentals, textbooks, online tutoring etc.

CHGG 0.00%↑ #QuickPitch mcap= $179.35M, price $1.73 / share

CHGG 0.00%↑ #Pitch:

Chegg positions itself as a go-to platform for students seeking affordable, on-demand, and personalized learning tools. It aims to save students time, money, and effort while improving academic performance. Despite these lofty goals, its recent financial performance and user feedback suggest cracks in the foundation.

Once a pandemic-era darling, Chegg thrived when online learning soared, but its fortunes have since reversed. Notably, Chegg is among the few companies blaming the rise of AI for its decline—a stark indicator of its struggles to adapt. This is not a good start for a pitch, right?

Over 80% of Chegg's revenue comes from subscriptions, creating predictable income streams. However, the education technology market is increasingly competitive, and Chegg’s ability to retain users has weakened.

One of the primary threats is OpenAI’s ChatGPT, which offers similar services for free. This disruption has forced Chegg to reconsider its offerings. In response, it is expanding into professional development and skill-based certifications, targeting not just students but also professionals. Whether this pivot succeeds remains to be seen.

The company has implemented cost-saving measures, including a 21% workforce reduction, to focus on AI integration and new product development. Chegg hopes to boost engagement by introducing conversational AI features, aiming to make its services more interactive and user-friendly.

However, the competitive pressure from AI platforms remains an existential threat. If Chegg cannot differentiate its products, its survival is uncertain. Additionally, domestic market saturation has forced the company to explore international opportunities, which come with risks like cultural adaptation and regulatory hurdles.

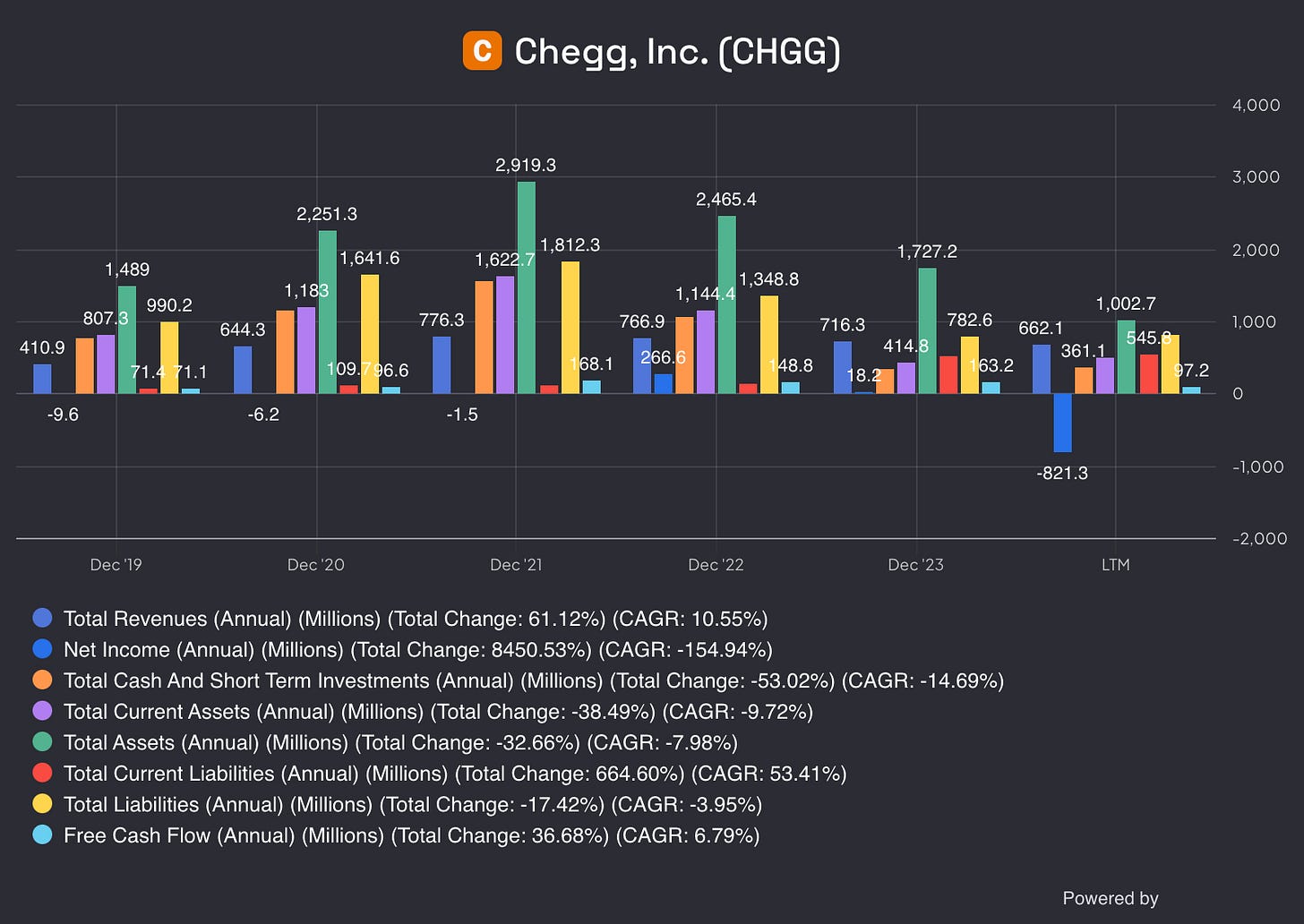

Chegg's financial position offers some relief. It has enough liquidity to meet short-term obligations, and recent cost-cutting should help improve margins. However, these efforts may not suffice to offset the rapid decline in revenues and market share.

Management remains optimistic, citing "early progress" in a strategic plan launched in mid-2024. Q3 delivered better-than-expected revenue of $137 million and $22 million in adjusted EBITDA. While a turnaround might be possible, the odds don’t inspire any confidence.

“The first impact I’d like to discuss is Google’s broad rollout of its AI Overviews search experience, or AIO, which displays AI-generated content at the top of a search results page. This experience keeps users on Google’s search results page instead of leading them onto third-party sites such as Chegg.” Chegg’s management recently attributed part of its struggles to Google. This public blame-shifting highlights their failures.

CHGG 0.00%↑ #Valuation:

Chegg’s valuation reflects its current struggles. Revenue declined 13.5% year-over-year in Q3 2024, highlighting its difficulty retaining users. The broader concern is its long-term growth trajectory, which looks increasingly precarious and the business looks more and more like a value trap.

While challenges persist, the company’s low valuation could present some upside potential if its restructuring and growth strategies succeed, making it a speculative bet. However, this is not my cup of tea.

Over the past 12 months, Chegg generated $662.08 million in revenue but posted a staggering $821.28 million loss, equating to -$8.10 per share. Revenue is projected to shrink further, declining by an average of 6.6% annually.

Expected Gain: Until Chegg can demonstrate that it has halted the bleeding, this company remains in the "too-hard" pile for me.