$BIDU Quick Pitch

Founded in 2000 as a search engine platform, BAIDU inc. was an early adopter of artificial intelligence to make content discovery on the internet easier.

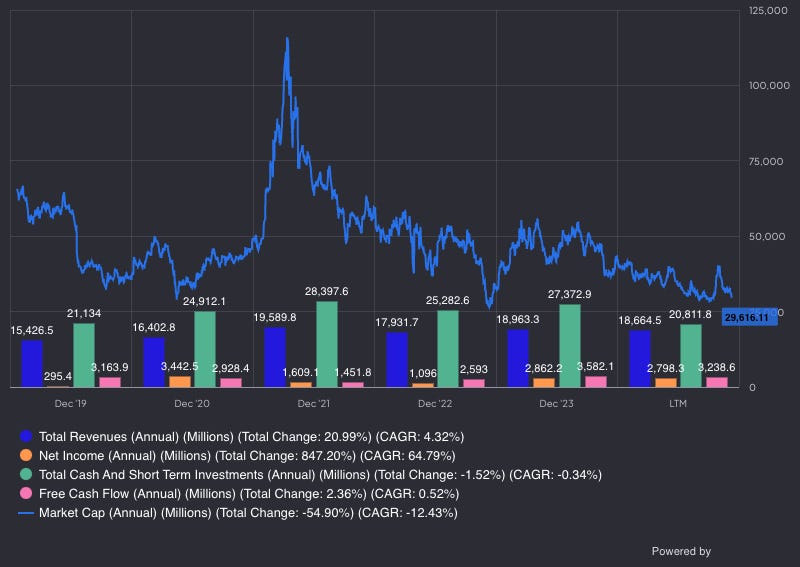

BIDU 0.00%↑ #QuickPitch mcap= $29.62B, price $84.46 / share

BIDU 0.00%↑ #Pitch:

Baidu’s AI Cloud is thriving and doing a good job of balancing out some challenges in traditional online marketing. With more businesses adopting cloud services, Baidu is positioning itself well in the world of AI cloud solutions.

Over in Wuhan, Baidu’s Apollo Go driverless ride-hailing service is making waves by offering fully autonomous rides across the city. While autonomous driving isn’t exactly my cup of tea, it’s exciting to see how the government is becoming more supportive of these technologies. This could mean great things for Baidu as the industry continues to grow.

Baidu's ERNIE 4.0 Turbo is a game changer for its AI offerings, providing powerful and cost-effective capabilities. It’s specially designed for industrial applications, helping to solidify Baidu’s place in China’s AI-driven markets.

The Baidu mobile app has reached an impressive 703 million monthly active users as of Q2 2024, which is a 4% increase compared to last year. This huge user base is fantastic for engagement and provides valuable insights for online marketing and monetization.

Also, Baidu’s PaddlePaddle platform, which is an open-source AI framework, has seen amazing growth with 14.7 million developers joining as of mid-2024. It would be wonderful to see that community continue to flourish. Check out this MIT Technology Review article.

Baidu has also shown its commitment to shareholders by repurchasing around $1.2 billion worth of shares in its 2023 buyback program. This highlights their strong cash position and dedication to returning value to those who invest in the company.

Of course, like many businesses, Baidu faces some regulatory challenges in China, especially regarding data privacy and AI oversight. Changes in regulations could create hurdles for growth, particularly in sensitive areas like autonomous driving and AI. Baidu competes against big names like Alibaba and Tencent in the AI, cloud services, and autonomous driving sectors. This friendly competition keeps things exciting but could impact Baidu's market share and profit margins.

Additionally, Baidu’s core online marketing revenues are affected by the economic climate, particularly with China experiencing some slower growth. While recovery is underway, long-term downturns could impact advertising budgets and create challenges for Baidu's services.

Investing heavily in research and development is key for Baidu’s innovation. However, it does come with some financial risk if autonomous driving doesn’t achieve widespread adoption.

BIDU 0.00%↑ #Valuation:

Baidu seems to be an exciting opportunity. With strong profitability, a low P/E ratio, and a track record of beating earnings expectations, it has a lot going for it. Of course, we should keep an eye on some potential risks, like China's economic challenges and any regulatory hurdles that may arise.

In its Q2 2024 report, Baidu announced flat revenue of RMB 33.9 billion ($4.67 billion). This stability was supported by steady growth in its AI and cloud businesses while the marketing revenue declined. Even with some headwinds in the broader economy, Baidu's diverse revenue streams have shown remarkable resilience.

Their operating income reached RMB 5.9 billion ($818 million) in Q2 2024, reflecting an 8% increase from the previous quarter. This increase indicates that they are managing costs effectively and can maintain profitability while expanding their AI investments. Plus, they have a strong cash position, with over $22 billion available. This financial strength allows Baidu to invest in research and development and return value to shareholders, all while providing a safety net during uncertain times.

They also generated RMB 6.3 billion ($862 million) in free cash flow in Q2 2024, which is a great sign of their ability to fund growth initiatives internally. I’m particularly happy that their selling, general, and administrative expenses fell by 9% year-over-year in Q2 2024, thanks to reduced marketing costs and credit management. It’s great to see such good cost control.

Currently, Baidu's P/E ratio sits at around 11x, which is lower than most of its peers. This might indicate that Mr. Market is not recognizing Baidu’s true potential. If the AI and autonomous driving sectors grow as expected, we could see a significant boost in Baidu’s valuation.

While it's common for Chinese internet companies to face higher valuation discounts due to corporate governance and regulatory concerns compared to Western firms, I feel that the current valuation differentials more than account for this. Interestingly, Baidu is the first tech company I’ve noticed trading below its book value.

Expected Gain: China has unleashed a digital monster. With growth opportunities in AI, cloud, and autonomous technologies, I believe that with an estimated $3 billion in free cash flow and a 10% discount rate, the company could double in value.

I linked to your piece in my Monday links collection post: Emerging Market Links + The Week Ahead (November 24, 2024) - China bank loan misappropriation worries, more Adani troubles (US indictments), Macau rising, Javier Milei interview, strong USD to hit EM bonds, EM stock picks & the week ahead for emerging markets.

https://emergingmarketskeptic.substack.com/p/emerging-markets-week-november-24-2024

It trades for <1x EV/EBITA and 0.3x P/E when excluding net cash and LT investment from MCAP - crazy cheap. Investors may never see most of that cash though; buybacks barely offset SBC.